When two people enter a marriage, they equally share the profits from the marriage. However, if the marriage dissolves or the spouse dies, then the spouses will have to opt for equalization of net family property.

Equalization is a right that ensures both parties get a fair share of the property accumulated during a marriage. So, if you want to know more about this process, you have come to the right place.

Here is a complete guide that will help you understand equalization payments during a divorce in Ontario.

What is Equalization of Net Family Property?

View this post on Instagram

As a marriage ends, the question of who gets what is an important one to answer. The spouse with a higher total of money has to pay the spouse with a lower total, which is known as equalization payment.

As the name suggests, it equalizes the payments to ensure an equal division of finances between both partners. According to the Ontario Family Law Act, both spouses are entitled to equal marital profits.

The right to equalization occurs when the spouse passes away, or the marriage is terminated. Watch our Instagram video above to learn more about the process of the equalization of net family property.

What is Property under the Family Law Act?

Property is any debt or asset acquired by spouses during the marriage. It doesn’t matter if these were owned jointly or individually.

Some examples of property can include the following:

- Bank accounts

- Pensions

- Investments

On the other hand, the Family Law Act also states that any debt spouses own during the marriage will have to be divided equitably during separation or divorce.

Both parties will be responsible for joint debts incurred during the marriage. Each spouse must pay back the amount they owe once the marriage is terminated through annulment or divorce in Canada.

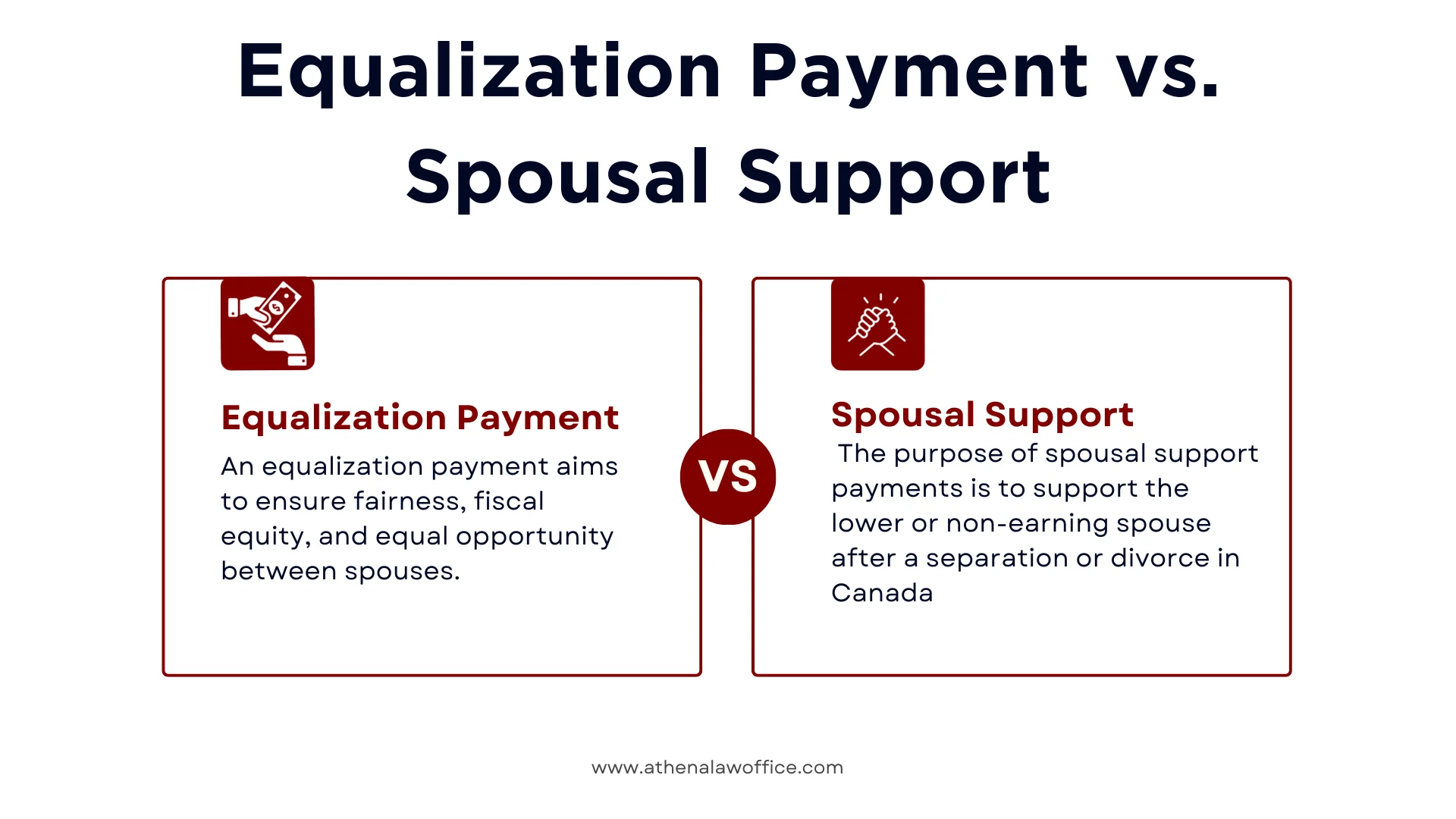

Equalization Payment vs. Spousal Support

Equalization payment vs. spousal support are two different things. An equalization payment aims to ensure fairness, fiscal equity, and equal opportunity between spouses.

On the other hand, the purpose of spousal support payments is to support the lower or non-earning spouse after a separation or divorce in Canada. It guarantees that the spouse can maintain their standard of living even after separation.

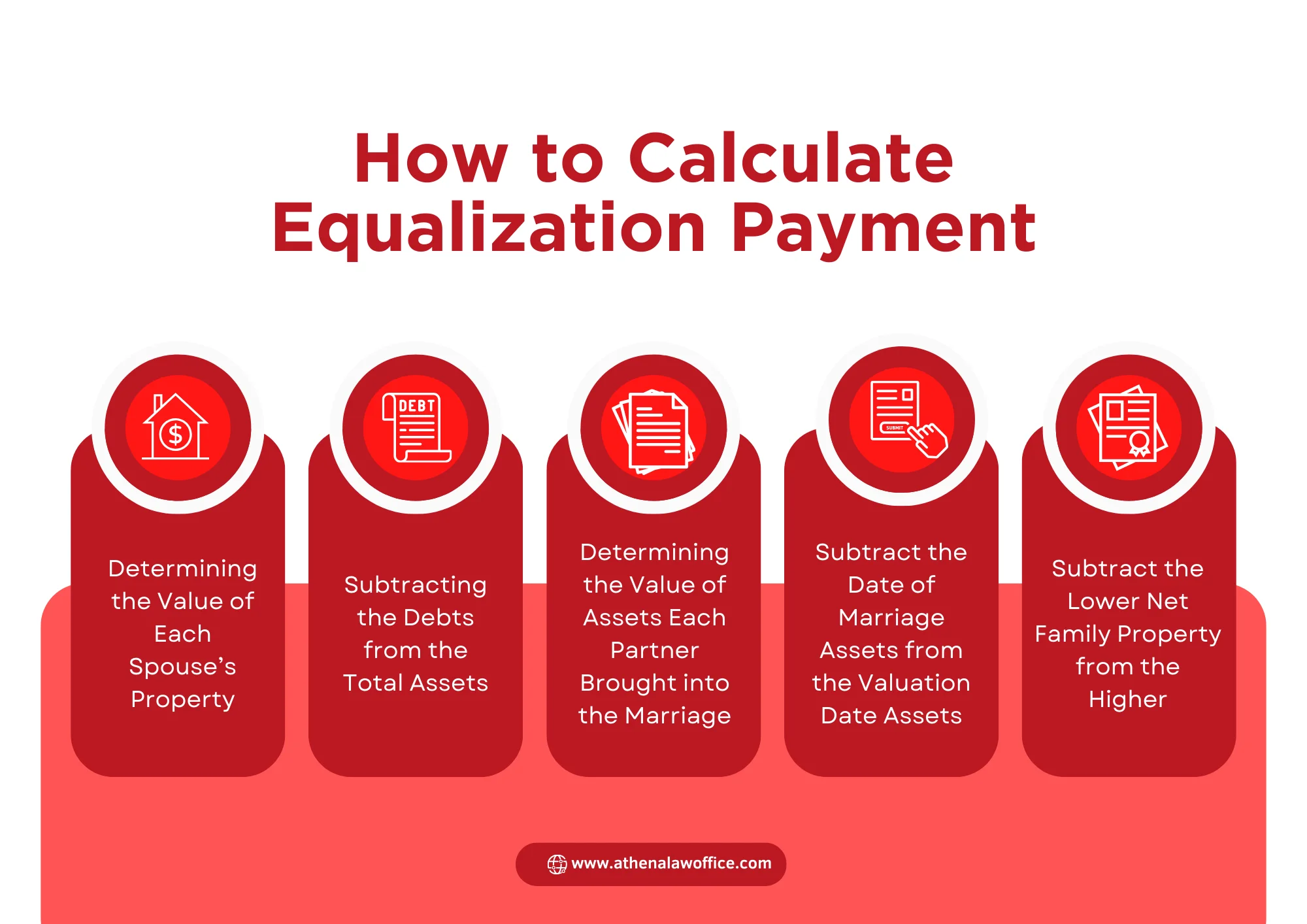

How to Calculate Equalization Payment: 5 Practical Steps

Now that you know what is an equalization payment, it is also crucial to know how to calculate it. Let’s review the steps you can follow to successfully calculate equalization payments in Ontario:

1. Determining the Value of Each Spouse’s Property

The first step to calculating equalization payments in Ontario is to determine the property each spouse owns and its value. These will include all the assets that the spouse owns except the ones excluded by the Family Law Act.

You have to add the value of all the properties to obtain a total value of the assets. Net Family Property (NFP) is what the spouse owns on the date of valuation (separation date) after deductions such as liabilities and debts have been made.

Please note that this doesn’t include the matrimonial home owned at the marriage important. Two dates important for calculating the equalization of net family property are the marriage date and valuation date.

The valuation is when the parties separate. Under the Family Law Act, it is defined as:

- The date the courts grant divorce

- Separation date

- The date the marriage is null

- Date before the day one of the spouse passes away

- The date one of the spouses starts an application of improvident depletion

These dates will help the family lawyer in Ontario to figure out equalization payments.

2. Subtracting the Debts from the Total Assets

Once the total assets of each spouse have been calculated, it is time to subtract the debts from it. Doing this provides a clear value of the total value of each spouse during the valuation date.

If one spouse has more debts than assets at the valuation date, then their total on the day will be zero for the next calculation.

3. Determining the Value of Assets Each Partner Brought into the Marriage

Next, your divorce lawyer in Ontario will determine the value of assets at the date of your marriage. Remember that this value doesn’t include the matrimonial home if you and your spouse owned it at the time of your marriage.

On the other hand, if one of the spouses had a negative net worth at the time of marriage (i.e., more debts than assets), then the lawyer will have to maintain that number and move on to the next step.

4. Subtract the Date of Marriage Assets from the Valuation Date Assets

Now, it is time to subtract the assets of the date of marriage from the assets during the valuation date. If the date of marriage and net worth of a spouse is negative, then you will use this number, which will lead to an addition.

When you conduct this calculation, the figure will be the net family property of each spouse. This will include the value of assets gained during the marriage and their increase.

In almost all cases, one spouse has a higher net family property than the other.

5. Subtract the Lower Net Family Property from the Higher

The equalization of net family property is done by subtracting the lower one from the higher one. Then, the difference number will be divided in half.

The number you receive now will be the equalization of net family property, which the spouse with the higher net property will have to pay to the spouse with the lower NFP.

A Practical Example of the Calculation of Net Family Property

Now that you understand the theory behind the equalization of net family property, it is important to understand it practically.

Let’s take an example and do a calculation to see what equalization payments will look like in reality.

Spouse A has a net worth of:

- $50,000 on the marriage date, and

- $150,000 on the valuation date

When you subtract both these numbers, the net family property of Spouse A is $100,000.

On the other hand, Spouse B has a net worth of:

- $20,000 on the marriage date, and

- $30,000 on the valuation date

When you subtract both of these, Spouse B has a net family property of $10,000.

Now:

| Calculating the Net Family Property | Amount |

| Spouse A NFP | $100,000 |

| Spouse B NFP | $10,000 |

| Spouse A subtracted from B | $90,000 |

| $90,000 divided by two | $45,000 |

The equalization payment from Spouse A to Spouse B will be $45,000.

Equalization Payment and Matrimonial Home: What You Must Know

As the name suggests, the matrimonial home is one where the married couple lived together before separation. A married couple can have one or more matrimonial homes, and they can be owned or on rent.

An important note to keep in mind is that if one spouse owns the home on the date of marriage and separation, then you don’t include the home value or debts on the marriage date.

Instead, you have to add the matrimonial home value, subtracting the debts on the separation date. In simple terms, this means that the total value of the home is shared in the equalization payments.

Such calculations can have a significant impact on the total equalization payment amount, as the total value of the matrimonial home is shared in the equalization payments.

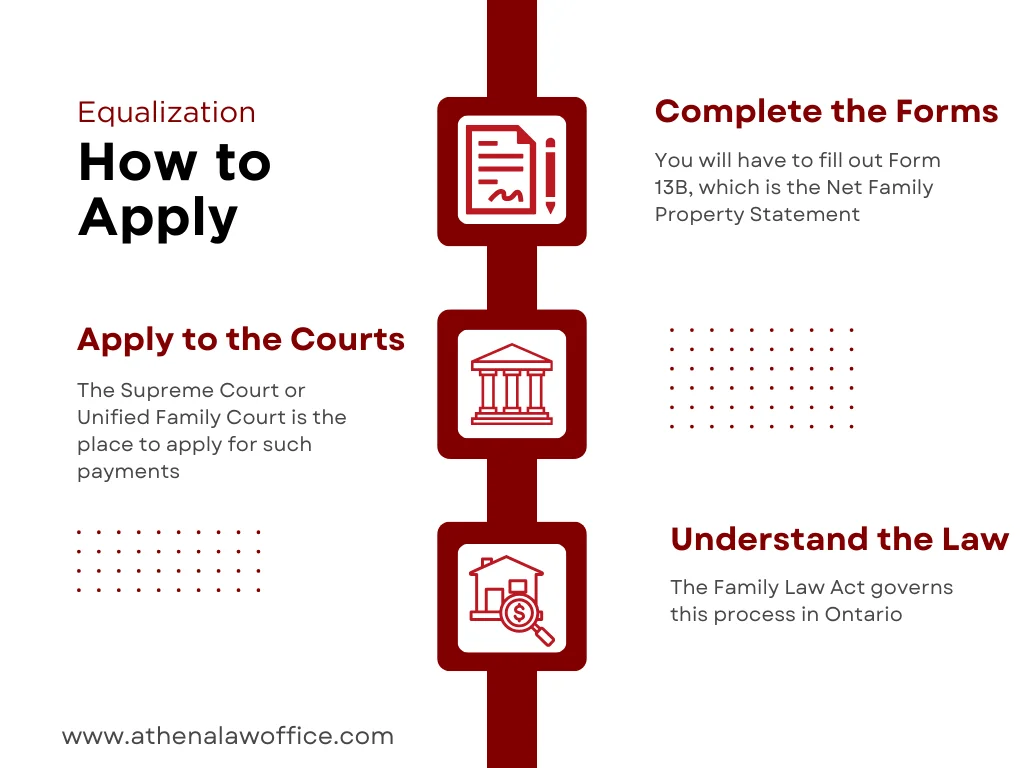

How to Apply for Equalization of Net Family Property?

You will have to apply for the equalization of net family property in the courts. If you have hired a divorce lawyer in Ontario, then they will handle this process for you.

Here are the steps you can follow during the equalization process in Canada:

1. Complete the Forms

Completing the net family property calculation forms is important when separating from your spouse. You can do this while you are creating a separation agreement in Ontario or while filing for divorce with your spouse.

You will have to fill out Form 13B, which is the Net Family Property Statement. If you don’t know where to begin this calculation, then you can hire a divorce lawyer in Ontario to fill these forms for you and complete the process.

2. Apply to the Courts

You must apply to the courts for equalization. The Supreme Court or Unified Family Court is the place to apply for such payments.

Generally, you can apply for equalization payments six years from the date of separation or two years from a divorce declaration. On the other hand, if your spouse has passed away, then you can apply for the payments six months after your spouse’s death.

3. Understand the Law for Applying

Finally, it is crucial to understand the law so you can apply it in the correct manner. For example, you can also apply for equalization payments even in the absence of a marriage dissolution or spousal death.

Section 5 (3) of the Family Law Act dictates that during cohabitation, one of the spouses can improvidently deplete the net family property. In such a case, the other spouse can apply for equalization payments.

On the other hand, you can also apply if your spouse has diminished mental capacity, deteriorating health, or suffering from a substance addiction or gambling problem.

Remember that if you apply for equalization because of these reasons, then you will not get further equalization if the marriage breaks down later on.

You will only get subsequent equalization payments if the other spouse has specified that in a separation agreement to allow for it beforehand.

Can A Court Depart From Equalization Payments?

There are limited cases where the court can reject equalization payments and instead award another amount that can be less or more than half the difference of the net family properties.

Some of the reasons for departing from equalization payments can be the following:

- When one spouse doesn’t disclose liabilities or debts at the time of marriage

- A significant portion of the net family property of one spouse constitutes gifts from the other spouse

- One of the spouses incurred liabilities or debts in bad faith or through reckless endeavours

- The spouses have been cohabiting for less than five years, and equalization would lead to one spouse getting disproportionate payments

- One spouse incurred a disproportionately significant portion of liabilities and debts to support the family

There are many other cases, but these are the top reasons why a court can reject equalization payments or vary from them. The specific outcome will depend on your case and property matters between you and your spouse.

FAQs

What is the equalization of net family property in Ontario?

The equalization of net family property is calculated by subtracting the net family property of one spouse from the other. The NFP of each spouse is the total assets and debts owned by the spouses on the separation date.

What is the equalization law in Canada?

When a marriage terminates or the spouse dies, each partner becomes entitled to one-half of the property value that was accumulated during the marriage.

How is property divided after divorce in Canada?

The property owned during the marriage that exists will be divided equally between the spouses. Each spouse will get half of the value of the family property in Canada.

Is everything split 50/50 in a divorce in Canada?

Yes, the Family Law Act in Ontario states that assets accumulated during the marriage should be split in half between the spouses.

Final Thoughts

That was your complete guide to the equalization of net family property. If you are going through a divorce, then it is crucial to understand these payments, so you know what you are getting.

If you want to learn more about equalization payments in Ontario, you can get in touch with our law office. We will be more than happy to help you out and help you understand this further.

Author Profile

- Athena Narsingh is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

legal guidanceMay 9, 2024How Can I Get a Copy of My Notice of Assessment from the CRA for Divorce Proceedings?

legal guidanceMay 9, 2024How Can I Get a Copy of My Notice of Assessment from the CRA for Divorce Proceedings? legal guidanceApril 25, 2024How to Get a Restraining Order in Ontario Against Your Ex-Spouse

legal guidanceApril 25, 2024How to Get a Restraining Order in Ontario Against Your Ex-Spouse legal guidanceApril 15, 2024How to End Common-Law Relationship in Canada: 8 Steps to Follow

legal guidanceApril 15, 2024How to End Common-Law Relationship in Canada: 8 Steps to Follow legal guidanceApril 2, 2024Divorce Rate in Canada: A Dive into the Key Trends and Takeaways

legal guidanceApril 2, 2024Divorce Rate in Canada: A Dive into the Key Trends and Takeaways