A commercial lease agreement is a written contract between a landlord and their tenant. It can help you negotiate details that allow you to use a rented space seamlessly.

Every landlord and tenant is recommended to draw up this legally binding contract. You should also know your commercial tenant rights Ontario when signing a business lease.

If you’re confused about the meaning of a commercial lease agreement Ontario, there’s no need to worry. Here’s everything you must know about this contract and your commercial tenant rights Ontario.

Ontario Commercial Tenancies Act

The Ontario Commercial Tenancies Act (CTA) highlights the relationship between a landlord and a tenant. It states the obligations a landlord has towards their tenant.

For example, it outlines the things that a landlord and tenant must include in their lease agreements such as tenure length. The CTA also highlights the obligations a tenant has toward their landlord such as timely rent payments.

If any party doesn’t follow the legal obligations they have to each other, they may face consequences under the CTA. You must also remember that negotiated details in a commercial lease agreement Ontario have superiority over the CTA.

So if a specific detail you decided on is different in your lease agreement than what the CTA says, you must follow the contract’s point.

Violating the contract’s terms even if you don’t violate the CTA can get you in trouble.

Understanding Commercial Lease Agreement Ontario

When a tenant rents a commercial space such as for office use, they must sign a contract with the landlord. This is called the commercial lease agreement.

A commercial lease agreement in Ontario is a legally binding contract that you can draw up with your landlord to specify details of your rental. A lawyer can help you develop the contract and its details.

For example, it can include the duration of your tenure. The contract can also include the rent you must pay and whether the landlord is allowed to implement rent increases.

Every commercial lease agreement is different because the negotiated details depend on the needs of the landlords and tenants.

Types Of Commercial Leases

Before understanding the components of commercial leases, you must know the types of business leases you can sign for a rental commercial property.

1. Gross Lease

A gross lease is the most common business lease that a tenant may sign for the commercial space. You are required to pay a fixed monthly rent to use the rental unit.

Meanwhile, the landlord will be responsible for covering additional expenses such as:

- Property insurance

- Building taxes

- Maintenance costs

- Operating costs

This business lease is a great option for businesses because you will never be blindsided by additional expenses.

2. Net Lease

A net lease requires you to pay a fixed base rent with some taxes that apply to the real estate property. For example, you may have to pay some amount for the office insurance.

However, the operating costs of the space will still fall under your landlord’s purview. Typically, you’re required to cover your rent and one additional cost in a net lease.

3. Double Net Lease

You must pay your rent with two additional costs in a double net lease. This may include the property tax of the space you’re using.

The insurance amount must also be paid by you in a double net lease. Its main purpose is to reduce the expenses of a landlord.

4. Triple Net Lease

A triple net lease is a rental agreement in which you must pay all costs of the building. These include:

- Operating costs

- Repair costs

- Utilities cost

- Property taxes

Such a lease mainly applies to industrial properties because landlords don’t want to take responsibility for the expenses of big rental spaces. This means you must pay the rent and maintain the property.

5. Percentage Lease

Percentage leases are for specific tenants such as businesses in malls. Your landlord may charge a percentage of your gross revenue along with base rent.

You will have to provide them with your bi-annual or annual financial statements. Once you reach a minimum gross revenue point, you’ll have to pay a commission percentage with your rent payments.

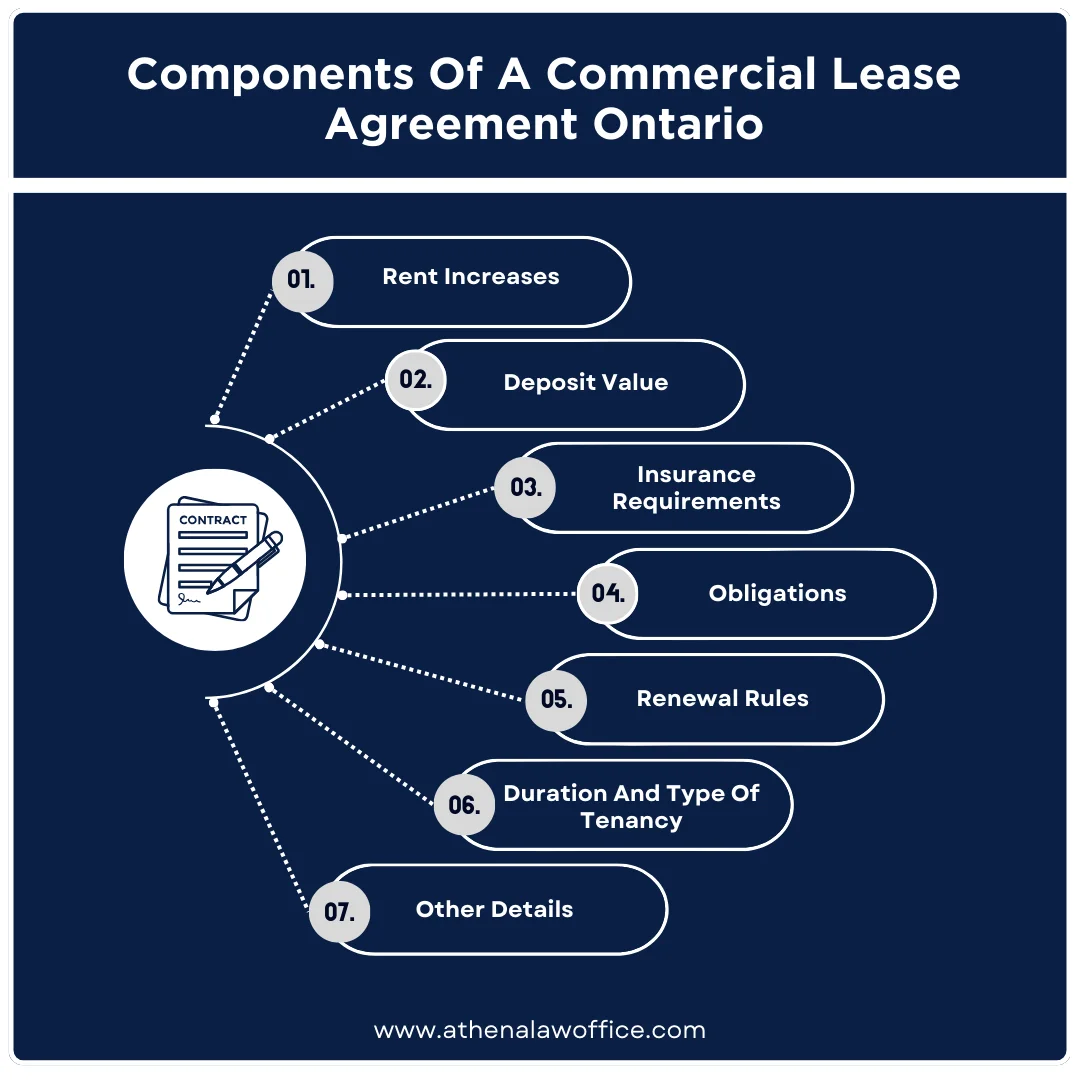

Important Components Of A Simple Commercial Lease Agreement Ontario

A simple commercial lease agreement must state the type of lease a tenant has with their landlord. It should also include other key elements such as:

1. Rent Increases

The CTA does not cover any rules about rent increases. This means a landlord can increase your base rent at any time to cover more of their expenses.

You can protect yourself from such increases by including details of rent in your commercial lease agreement Ontario. The landlord must agree with you on a specific rent charge.

A commercial lease agreement can also include the frequency of rent increases if your landlord wants to charge more after some time. You can also put a demand of a notice before the increase so that you can prepare yourself.

You and your landlord may also discuss a maximum percentage by which they can increase the rent in any year. According to rental rules in Canada, the maximum increase a landlord can make is 2.5%.

If you want a lower maximum percentage, you may negotiate its details with the landlord and include it in your agreement.

2. Deposit Value

The lease agreement must always include the deposit value you’re paying the landlord. This will protect you from any additional charges by the landlord.

Some landlords may also file a complaint against you by saying you owe them some deposit money. However, your dues may be clear. This is why always include the value you pay to the landlord in your commercial lease agreement Ontario.

3. Insurance Requirements

If you have a gross lease, you will not have to worry about this key component. Your landlord will pay any amount for insurance in a gross lease.

However, you may have to pay for insurance in other leases such as double net or triple net leases. So you will have to work out insurance requirement details in your commercial lease agreement.

The agreement must include:

- Total amount of insurance

- Monthly payments you must give for insurance

- Things covered by the insurance

These details must be figured out comprehensively because a landlord may make you pay for insurance for a part of space that you may not be occupying.

4. Obligations

A commercial lease agreement Ontario must set out any obligations you may have towards the landlord. It should also cover the vice versa scenario.

For example, the CTA requires you to make rent payments timely. However, your landlord may also set an obligation such as for you to pay rent at a specific time.

Some landlords ask for monthly rent, while others opt for quarterly. The obligation of rent payment in a specific pattern must be mentioned in the lease agreement.

This will help you avoid future trouble with the landlord. For instance, you may verbally decide on quarterly rent payments. However, your landlord may later start asking for monthly rent, which may put your business in a tight situation.

Stating obligations in your commercial lease agreement can prevent your landlord from engaging in inconsistent behaviour. The landlord can also keep obligation clauses to hold you accountable for payments and other things.

5. Renewal Rules

Many businesses believe the landlord will give them the rental space again after their lease expires. However, that is not true. Landlords don’t have any obligations to offer the same rental commercial property to the same tenant.

Once the contract expires, a tenant is required to remove their assets from the space and leave immediately. If you want to continue using the property, you must work out a renewal policy with the landlord.

If renewal rules aren’t included in your commercial lease agreement Ontario, you cannot continue using the space even if a verbal agreement was made.

6. Duration And Type Of Tenancy

A commercial lease usually lasts for three to ten years. The period may vary, depending on your business needs. This is why the lease agreement must state the duration of your tenure.

It should also include the type of lease you have. Mentioning this thing in writing can prevent you from being blindsided by the landlord. For instance, you may have a gross lease contract, so you’ll not have to pay any other expenses besides the base rent.

However, the landlord may try to make you pay for insurance by claiming you have a double net lease. They may also sneak in this information in the commercial lease agreement Ontario.

So you must always create a section in your lease agreement of duration and tenancy type. If you see any inconsistencies or mistakes, don’t sign the agreement unless changes are made.

7. Other Negotiated Details

The earlier key components are some common things that a lease agreement must have to protect commercial tenant rights Ontario. However, the lease agreement can also include other things that you see fit according to your business needs.

Remember the landlord can also add other clauses in the lease agreement for their protection. This is why you must discuss the details of the contract with your landlord thoroughly.

Commercial Tenant Rights Ontario

Let’s look at the commercial tenant rights Ontario offers to businesses:

1. Tenants Are Entitled To One Month’s Notice If Landlord Wants To End Tenancy

The commercial lease agreement Ontario may state that your tenancy will end after five years. However, the landlord may put a clause that they can end the contract early under specific circumstances.

If such a thing happens, remember you’re entitled to receive a month’s notice before the tenure ends. A landlord must send you a written document stating they want to end the lease early and must mention the reason behind it.

This means a landlord cannot just evict you on the spot in Ontario. If they don’t offer a notice before ending tenure, you can file a case against the landlord for violation of the lease agreement.

2. A Tenant Can Sublet The Property

Sometimes you may rent a space for a few years, but your business may expand or move to another location after a specific period. You may want to end the lease early, but your commercial agreement may prevent you.

In such cases, remember you have the right to sublet the property to another tenant. The new tenant will continue your contract and pay the rent accordingly.

However, if the sublet tenant ends their agreement with you and leaves the property, you will again have to make the remaining payments for your lease.

3. Tenants Must Receive A Notification Before Property Sale

The commercial tenant rights Ontario offers you protection by ensuring the landlord cannot sell the property before notifying you.

Typically, the landlord must send you a notification at least three months before the sale. This will give you enough time to find a new place for your business.

You can also file a complaint against the landlord if you agreed in the commercial lease agreement Ontario that the landlord cannot sell the place during the tenancy.

What Happens On Breaking A Commercial Lease In Ontario?

If you break a commercial lease agreement Ontario, you must face consequences. These include:

No Access To The Unit And Eviction

An overdue rent payment gives the landlord the right to change locks on your rental space. This is especially true if you have a pattern of delaying rent payments. The landlord is required to wait for 16 days for the rent.

If you don’t pay them in this window, the landlord is allowed to change locks on the 17th day. They can prevent you from accessing the unit until you clear the payments.

The landlord is also not required to notify before changing locks. However, you’re entitled to receive time to take out your things from the space according to commercial tenant rights Ontario.

Your landlord can change the locks and specify a day on which you can come and remove your assets from the property under supervision.

Asset Sale

If you break a commercial lease agreement, your landlord may not prevent you from accessing the property or evict you. Instead, they seize your assets within the rental space.

Such an action is called distress. The landlord can seize your office furniture without any prior notice. They can also sell the seized assets to recover their payment.

The rules a landlord must follow if they’re selling seized assets are:

- The landlord must notify you of the distress (e.g. overdue rent payment)

- Let you know the payment you must make to recover the seized asset

- Hold the asset for five days before selling it

If you clear your dues within five days of asset seizure, you will get it back. However, the landlord can sell the asset on the 6th day if you don’t clear the payment.

They will recover the overdue payment and pay you back any excess funds remaining from the sale.

FAQs

How Do Commercial Leases Work In Ontario?

A commercial lease works by including details that tenants and landlords must follow. If any party violates the terms, they can face consequences.

Can A Landlord Break A Commercial Lease Agreement Ontario?

A landlord can break a commercial lease agreement Ontario, but they must notify you before ending your tenure.

What Happens If A Landlord Prevents You From Exercising Commercial Tenant Rights Ontario?

You can file a complaint with the Superior Court of Justice if your landlord is violating the agreement or preventing you from exercising your rights.

Can A Landlord Keep My Rent Deposit If I Break My Lease Ontario?

A landlord must return your deposit if you break the lease unless you damage their property or have overdue rent payments.

Don’t Wait – Connect To Athena Law Office Today To Develop A Commercial Lease Agreement Ontario

A commercial lease agreement Ontario protects landlords and tenants from specific situations. If you want to draw such a lease, contact us today and let our expert lawyer help you.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario? legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario?

legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario? Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025?

Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025?