Buying a home in Ontario is a significant financial investment that you must make wisely. One of the factors that can impact your closing costs and overall real estate investment is the land transfer tax in the province.

The tax is payable whenever you buy a new property and register it with the provincial government. To help you understand how much is land transfer tax in Ontario, our real estate lawyer has crafted this comprehensive explanatory guide. Dive below to learn more.

What Is Land Transfer Tax?

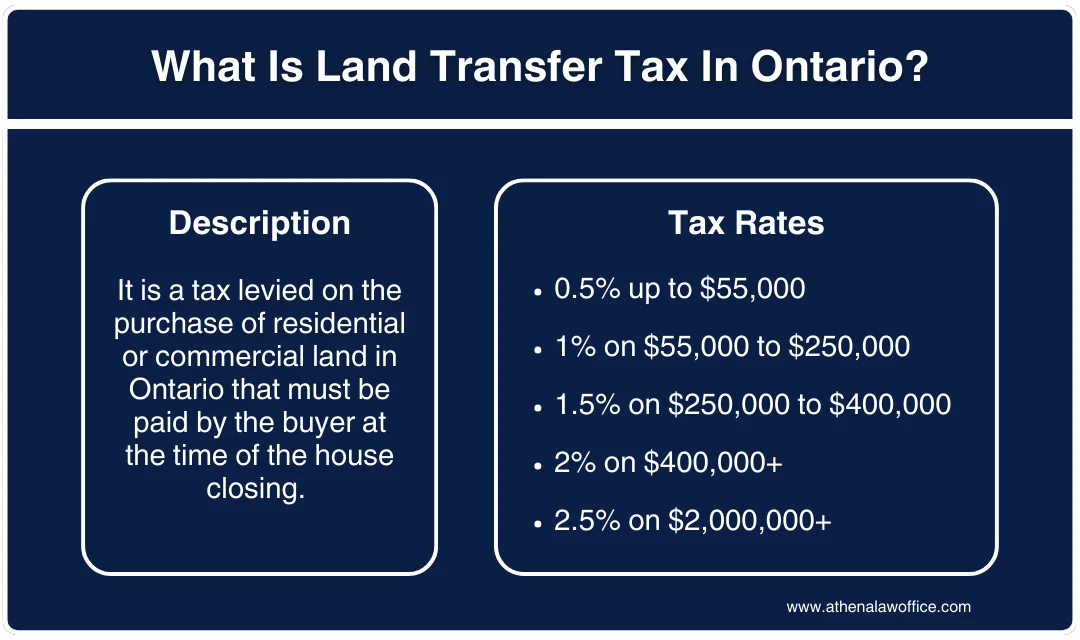

The land transfer tax is implemented by the Ontario government when property ownership is transferred in the province. For example, when you buy a new home in Ontario, the land transfer tax will apply upon registration of ownership.

Less commonly, land transfer taxes may be payable when you receive a beneficial interest in land without formal registration. For instance, you may be added to a trust that owns a property. This will offer you a stake in real estate, which may lead to the application of the land transfer tax.

The collection of this tax is mainly governed by provincial authorities in Canada instead of the federal government. In some cities, such as Toronto, the municipality also implements additional land transfer taxes during the sale and purchase of properties.

Who Pays Land Transfer Tax?

Buyers are expected to pay land transfer tax when they receive ownership of a newly bought property. The provincial government determines the payable tax amount using the purchase price at the house closing of a residential or commercial property.

However, sometimes exemptions may apply to paying land transfer tax in Ontario. The government requires the transfer of ownership to be meaningful. For example, you may want your spouse to become the sole owner of your marital home.

Transferring ownership to a spouse may be eligible for a land transfer tax exemption because the property is not being sold. The change in ownership doesn’t signify a typical real estate sale. Consulting a real estate lawyer is a great way to understand the exemptions of land transfer tax under the latest laws.

When Do You Pay Land Transfer Tax In Scarborough?

You will have to pay land transfer tax in Scarborough when closing a real estate deal. It is a one-time cost that applies when a transfer of ownership takes place during a property sale.

As Scarborough is part of Toronto, you will have to pay provincial (Ontario) land transfer tax and municipal land transfer tax (MLTT). Your real estate lawyer can help you manage the payment during the house closing process.

How Much Is Land Transfer Tax In Ontario?

Land transfer tax in Ontario is calculated by the value of consideration defined in subsection 1 (1) of the Land Transfer Tax Act. It applies the following marginal tax rates to specific portions of property purchase value:

- O.5% on the first $55,000 of the purchase price

- 1% on next $55,000 to $250,000 purchase price

- 1.5% on next $250,000 to $400,000 purchase price

- 2% on purchase price exceeding $400,000

- 2.5% on land with one or two single family residences exceeding $2,000,000

The earlier tax rate applies to all purchase agreements signed after 14th November 2016 and house closings after 1st January 2017.

How To Calculate Land Transfer Tax?

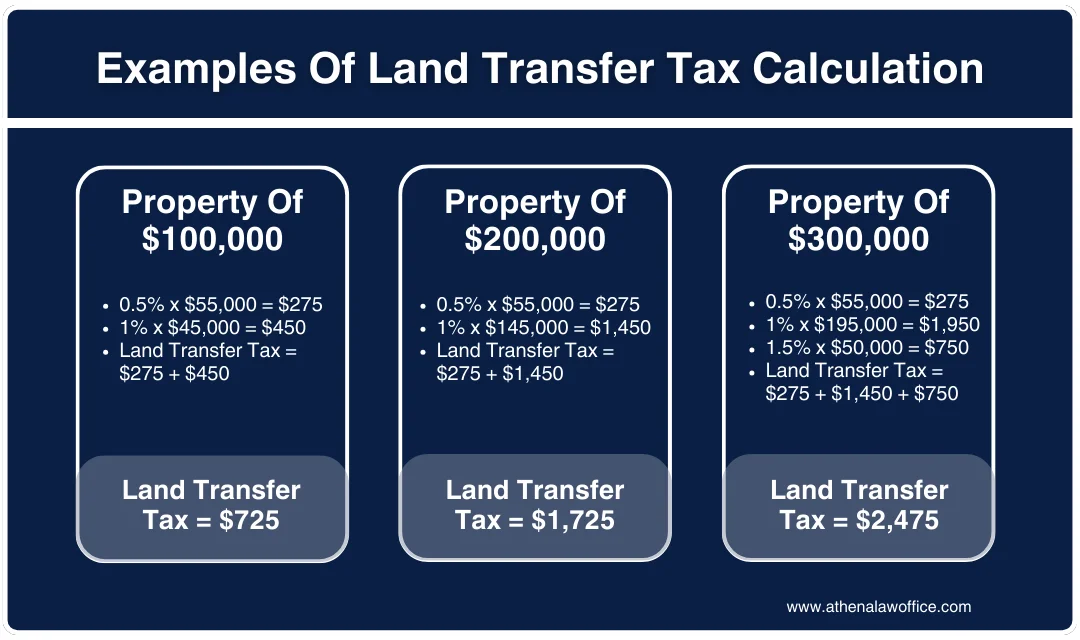

Many homebuyers get overwhelmed seeing the land transfer tax rates because they have no idea how to calculate land transfer tax using the marginal rates. Remember, this tax is calculated in tiers just like regular income tax in Ontario.

Let’s look at the land transfer tax calculation for a home with a purchase price of $500,000 for a better understanding:

- 0.5% will be multiplied by the first $55,000 of the purchase price to give a payable value of $275

- 1% will now be multiplied by $195,000 ($250,000 minus $55,000 is equal to $195,000) to give a payable value of $1,950

- 1.5% will be multiplied by $150,000 to give a payable value of $2,250

- Finally 2% will apply to the last $100,000 of the purchase to give a payable value of $2,000

- The total land transfer tax you must pay in Ontario for a property of $500,000 will be the sum of payable values, i.e. $275 + $1,950 + $2,250 + $2,000 = $6,475

For every property you buy and register in Ontario, the same land transfer tax calculation process will apply. You can consult a real estate lawyer in Scarborough to help you calculate land transfer taxes easily.

FAQs

Do You Pay Land Transfer Tax When You Sell?

Sellers of Ontario properties don’t have to worry about paying land transfer tax. It is always the buyer who must pay the tax, regardless of the province or municipality they’re in. Unlike other real estate taxes, this tax must be paid in full as a single payment upon signing a property purchase agreement or at house closing.

Do You Pay Land Transfer Tax On A New Build In Ontario?

If you’re buying newly built land, such as a residential home or commercial condo, you must pay the land transfer tax Ontario. The total payable value will be calculated using the purchase price of the newly built property.

Is Land Transfer Tax Included In Mortgage?

No, land transfer tax Ontario is not included in mortgage when buying a property. You cannot get it added to your mortgage agreement because the provincial laws require buyers to make a single land transfer tax payment in full during house closing.

Is Land Transfer Tax Deductible For Rental Property?

One of the rental expenses that you cannot deduct when you buy a property is the land transfer tax. The tax amount must be added to the cost of the property, regardless of whether it’s your home or rental property in Scarborough.

Calculate How Much Is Land Transfer Tax In Ontario With Barnett Law

The Ontario government has not launched an online land transfer tax calculator to assist buyers in calculating this complex real estate tax. However, you don’t have to worry about time-consuming calculations with Barnett Law.

Our real estate lawyer has years of experience in determining how much is land transfer tax. We use our in-house land transfer tax calculator to assist homebuyers in determining their final closing costs. Contact us today to work with our team to calculate your land transfer tax in Scarborough and Whitby.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

legal guidanceFebruary 11, 2026How Much Does A Separation Agreement Cost In 2026?

legal guidanceFebruary 11, 2026How Much Does A Separation Agreement Cost In 2026? legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario?

legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario? Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?