Land transfer tax (LTT) is a house closing expense that a buyer has to face when registering a new property in Ontario. It is legally mandatory to pay this tax, but there are ways to reduce its value or avoid paying it in some cases.

If you’re already overwhelmed by the property purchase costs, you may want to learn how to avoid land transfer tax Ontario. Let’s help you understand the steps you can take to reduce or completely avoid paying the LTT.

What Is Land Transfer Tax Ontario?

Land transfer tax is payable when a property’s ownership is being transferred in Ontario. It is also mandatory when an interest in a land is purchased in the province. The tax is calculated based on the:

- Buying price of the property

- Assumed real estate liabilities

- Benefits of property purchase

- Soft costs and any costs related to upgrading the property

In Toronto, people also have to pay an additional municipal tax besides provincial LTT for property transactions.

When Do You Pay Land Transfer Tax?

You have to pay land transfer tax if you’re buying a new property in Ontario and registering it under your name. Sellers don’t have to pay LTT in the province. The tax applies only to buyers.

Typically, you must pay the tax when you register the transfer of property ownership. It is recommended to do this within 30 days of the house closing in Ontario. Otherwise, you will have to file additional requests if you pass this deadline.

Can You Avoid Land Transfer Tax In Ontario?

Yes, you may be eligible for a land transfer tax exemption, depending on the real estate transaction. Sometimes, the provincial laws allow you to reduce the partial cost of the LTT.

However, it is also possible to receive a complete exemption from paying land transfer tax in specific cases, such as property transfers between family members. Consulting a real estate lawyer can help you understand if any exemption applies to your case.

How To Avoid Land Transfer Tax Ontario?

Avoiding the land transfer tax in Ontario legally is possible if you meet specific conditions set under provincial regulations. Here are the top six ways to reduce or avoid LTT legally:

1. First-Time Home Buyer Rebate

The commonest land transfer tax exemption in Ontario includes a first-time home buyer rebate. You can receive a refund on part of your LTT or all of it if you’re purchasing a home for the first time in your life. The conditions you must meet for this rebate include:

- You must not have a home registered under your name anywhere in the world, including Canada

- You’re 18 years old

- You intend to use the property as your primary residence within 9 months of the purchase

As per the regulations, all homes bought after 1st January 2017 qualify for zero land transfer tax for first-time purchases if the property value is up to $368,000. If the property you’re purchasing is above $368,000, you will only receive a refund of $4,000 on LTT in Ontario.

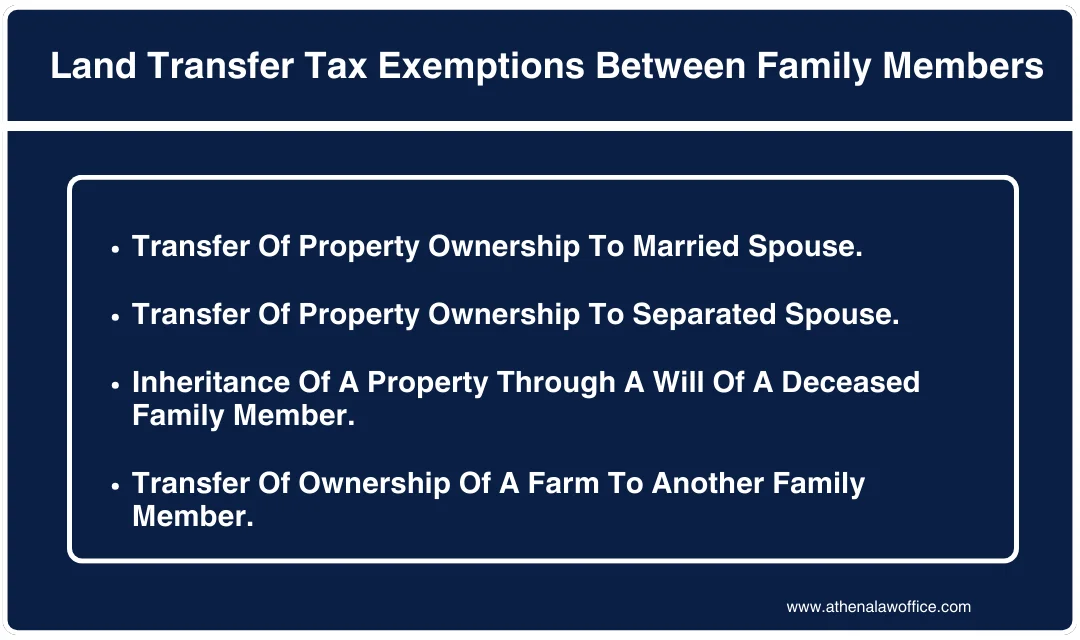

2. Transfer Of Ownership To Spouse

Real estate laws in Ontario allow land transfer tax exemptions between family members in specific cases. For example, there will be no LTT if you’re transferring ownership of a property to your spouse.

This rule is limited to married partners or common law partners only and not to other family members. The main reason behind the exemption is that there is no exchange of monetary value during the transfer.

3. Property Transfer For Separation Or Divorce

If you’re receiving ownership of a property from your legally separated or divorced spouse, the land transfer tax will be exempt. This is especially true if there is a court order stating you must receive the property from your ex-partner.

However, you must ensure there’s no extra consideration to be paid except for the mortgage. The transfer must also be compliant with any written separation agreement you’ve mutually signed with your former partner. If these conditions are not met, LTT will be applicable.

4. Inheritance Of Real Estate

Inheriting a property under a will after the owner’s death is exempt from land transfer tax in Ontario. The document must explicitly mention you as the inheritor; otherwise, you may not be able to avoid the LTT.

You must also ensure you haven’t paid someone for a share of their inherited property. If that’s the case, the exemption will not apply to you under Ontario real estate laws.

5. Reorganizing A Corporation

The Land Transfer Tax Act has a section that governs the exemption of tax when reorganizing a corporation. This means property transfers between two or more related business corporations or shareholders are free of land transfer tax. The exemption is useful when you’re:

- Restructuring your business

- Merging with another corporation

- Tax planning

When taking these business measures, it is better to seek legal assistance from a real estate lawyer in Scarborough and Whitby. The professional will help you file for exemption legally.

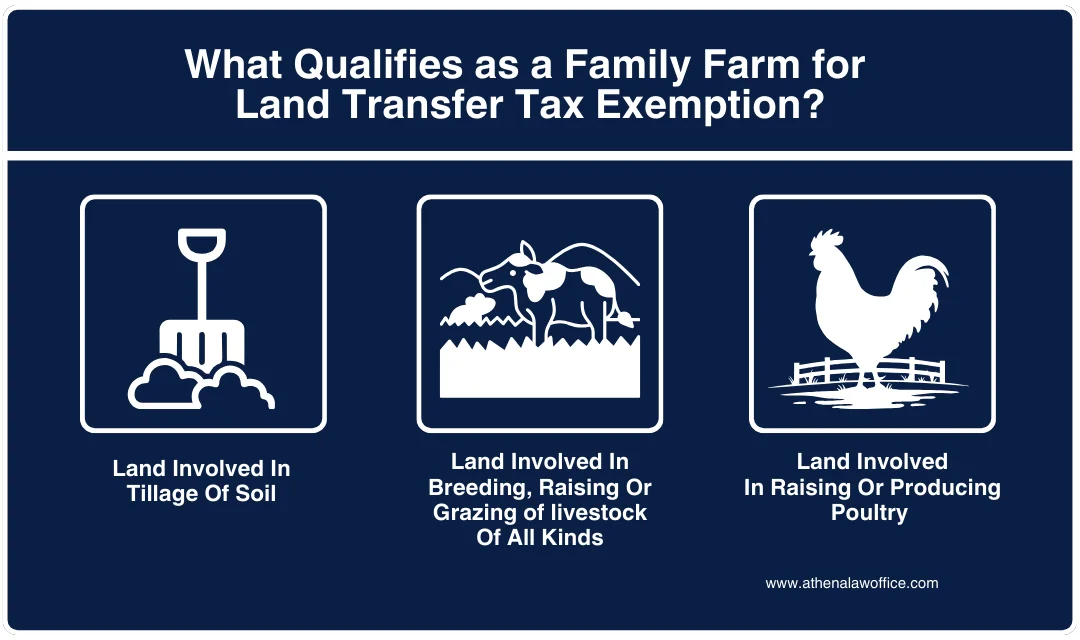

6. Family Farm Exemption

The final land transfer tax exemption includes family farm transfers. Generational farming is supported by the Ontario government. This is why, if a farm property is transferred from one family member to another, the payable land transfer tax is zero.

To benefit from the family farm exemption, you must meet the following criteria:

- You will continue to use the land for farming

- You’re related to the former owner of the farm by blood or marriage

If the property transaction is not between family members, the land transfer tax will be calculated using the property laws.

How To Claim Land Transfer Tax Exemption?

You can claim Ontario land transfer tax exemptions by submitting an affidavit to the provincial land registry office. An experienced real estate lawyer can help you prepare the land transfer tax affidavit.

The document will state your exemption category and will be supported with evidence such as:

- Court order of property transfer in cases of separation from spouse

- Marriage certificate in cases of ownership transfer to the spouse

- Refund affidavit for first-time home buyer rebate

If the registry office deems your case to be eligible, you will not have to pay land transfer tax in Ontario.

FAQs

Who Pays Land Transfer Tax In Ontario?

A real estate transaction includes two people: the transferor (person who currently has ownership of the property) and the transferee (person who will receive ownership of the property at the house closing. The land transfer tax is always paid by the transferee in Ontario.

How Do I Not Pay Land Transfer Tax In Ontario?

You can avoid paying land transfer tax legally by meeting the conditions of exemption in cases of transfer to a spouse, inheriting real estate through a will, the first-time home buyer rebate, and family farming.

Who Is Eligible For The Land Transfer Tax Rebate In Ontario?

First-time home purchases are eligible for a land transfer tax rebate if they meet the eligibility criteria, including the minimum age of 18 when registering the property. A real estate lawyer can help you apply for the rebate easily in Ontario.

Why Does Ontario Have A Land Transfer Tax?

Ontario has a land transfer tax to generate revenue for the province. It also ensures real estate transactions are properly recorded and governed. The revenue generated from the tax is used for improving public services in the province.

What Happens If I Don’t Pay Land Transfer Tax In Canada?

If you don’t pay the land transfer tax in Canada, you will not be able to register the newly bought property under your name. The Ministry may also implement specific penalties and prevent you from legally owning the property until you pay the LTT.

Apply For Land Transfer Tax Exemption In Ontario With Barnett Law Today

Ontario land transfer tax exemptions allow you to reduce your property purchase costs. Navigating the application for avoiding the LTT alone may be challenging. That’s where a real estate lawyer, such as Barnett Law, can help you.

We have a qualified team of attorneys who have filed hundreds of applications for land transfer tax exemptions in Scarborough, Whitby, and across Ontario. Contact us today to schedule a meeting with our expert real estate lawyer and start the process of LTT exemption.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

legal guidanceFebruary 11, 2026How Much Does A Separation Agreement Cost In 2026?

legal guidanceFebruary 11, 2026How Much Does A Separation Agreement Cost In 2026? legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario?

legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario? Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?