Child support guidelines have been introduced by the federal government for the protection of children’s rights. Even if parents get an annulment, divorce, or separate, the children must still have a similar standard of living.

However, you might not understand:

- What is the child support table amount?

- What happens if the payer doesn’t pay?

- What factors affect child support payments?

- How the federal guidelines affect the process

- And much more

After all, the process can be complex and last for years, at least until the child turns 18. So, if you want to know more about child support in Ontario, you have come to the right place.

We have created a comprehensive guide to help you understand the guidelines in as detail as possible.

What is Child Support?

Child support is the money that one parent pays another to help pay for the child’s costs. Usually, the payer of child support makes more money and spends less or equal time with the child.

Please note that this payer can be the:

- Birth parent

- Adoptive parent

- Non-birth parent

- Or step parent

In any case, where the adult has acted as a parent to the child, they will pay for the support. You will have to provide evidence of how the adult qualifies as a parent for the child.

Such evidence can include an adoption certificate, birth certificate, or marriage certificate. Such support is for children under the age of 18, as they are known as dependents at that age.

How do the Ontario Family Law Act and Federal Divorce Act Affect Child Support?

In Ontario, two Acts govern the laws of child support. For example, you can make a claim under the Federal Divorce Act during your divorce proceedings, or you can do it under the Family Law Act if you were never married to your partner or you want to opt for separation rather than a divorce.

Let’s review the federal guidelines and how they affect child support guidelines in Ontario:

Federal Child Support Guidelines

These guidelines are regulations in the Divorce Act that govern the orders of child support.

The Ontario Family Law Act also mirrors the federal child support guidelines, which is why the amount you pay will be identical regardless of the Act you make the claim under.

According to federal child support guidelines, child support is determined by taking a percentage of the gross income of the payer. Please note that this percentage will depend on the number of children involved.

The Child Support Table is the most important feature of these guidelines. These list the monthly support amount you have to pay based on the number of children and annual gross income.

How Does the Child Support Table Work?

You can think of the amount from the child support table as the baseline amount of support you will have to pay. Other than that, any additional expenses will have to be divided between the parents and added to the Table amount.

These additional expenses can include expenses such as healthcare, daycare, tutoring, and more. These amounts are standard and created to reduce any conflict between the parties and ensure the best interest of the children.

Deviating from the Child Support Table Ontario

There are certain circumstances where you can deviate from the child support table amounts in Ontario. These include the following:

- When you and your spouse consent to an amount in a contract that deviates from the table, but the court is satisfied with the agreement as it ensures adequate support for the children

- When you have made special provisions for the child in an agreement, and because of this, the table amount will lead to inequity. These provisions can be division or transferring property for the benefit of the child

If this is the case between you and your partner, then the judge will allow you to deviate from the child support guidelines. You can add certain provisions to your separation agreements before divorce or duringdivorce mediation in Ontario.

However, it is best you consult with a child custody lawyer in Ontario to ensure your case goes as smoothly as possible without compromising the interests of your children.

Who Pays for the Child Support?

Both parents are responsible for the emotional, mental, and financial upbringing of the child. As a general rule, the parent with whom the child resides will incur most of the cost.

Because of this, they will receive the support to ensure that the standard of living of the child remains the same. The parent that pays the child support will do so to ensure that not all the burden is on the parent that is living with the child.

Even if two people are in a domestic partnership in Canada and have a child, these guidelines will apply.

Can A Parent Refuse to Pay Child Support in Ontario?

The child support guidelines in Ontario guarantee that the payer fulfills their responsibility to pay for child support. In the event that one parent tries to avoid child support payments, you can apply under:

Section 4 (1) of the Children’s Law Reform Act for a paternity or maternity declaration.

On the other hand, the court can also order a DNA or blood test to prove parentage under Section 10 (1) of the same Act if the biological parent refuses to pay.

Who Receives the Child Support?

The parent that receives the child support payments is known as the recipient parent. This parent has the most parenting time or is the custodial parent based on the agreement between the spouses.

An important point to note is that the payer parent doesn’t have the discretion to determine how the support money will be used. It depends on the recipient parent how they want to use the income for the child’s best interests.

When Does Child Support End?

There are different circumstances where child support payments in Ontario can be dismissed. These include the following:

- The child has gotten married

- The child is sixteen years or older and has been emancipated or left the house voluntarily

- The child is 18 years old and not pursuing post-secondary education

Even if the child lives away from home to attend college or school, these payments may continue if the permanent residence of the child is with the recipient parent.

On the other hand, there are also some situations where child support payments can be extended. This includes when the child is:

- Dependent on parents for financial support

- Pursuing full-time education

- Disabled

- Battling an illness

Knowing these child support guidelines will help you understand the decision-making of the court and the lawyer’s advice.

How Much is Child Support in Ontario: Determining the Amount

Now that you have some background about the child support guidelines in Ontario, it is time to know how the court determines the child support payments.

If you want to know how much child support is in Ontario, here are steps you can follow:

1. View the Child Support Table as a Calculator

You can use the table as a child support calculator in Ontario. The support is determined based on the number of children and the gross annual income of the parent.

In practical terms, let’s say a parent is earning $100,000 annually and has two children. Then, the child support payments would be $1,471 per month.

We have done the calculations based on the Child Support Table Ontario 2017 Lookup. You can also enter your income and number of children in the calculator, and it will let you know the amount.

Please note that if your income is more than $150,000, then the courts have the discretion to depart from the Child Support Table amount.

According to Section 4 of Child Support Guidelines, the courts can take any of the following routes for payers that earn more than $150,000:

- The court can decide to award the Table amount applicable to that income

- The courts can decide to take the child support table amount for the first $150,000 for two children and for the income balance over $150,000. Then, it can add the amount it deems appropriate for the payments

- At last, the courts will add section 7 expenses from the Child Support Guidelines Ontario

There are rare times when the court decides to depart from the Table amount. So, in your case, the court may not depart from the child support table amount at all.

2. Adding Section 7 Expenses from Child Support Guidelines Ontario

Section 7 expenses in child support guidelines Ontario are special or extraordinary expenses that can be ordered in addition to the table amount.

The court will determine whether the expense falls under this section based on the following:

- How necessary the expense is for the best interest of the child

- How reasonable is the expense based on the payer spouse’s means and the spending pattern of the family before the separation

Some possible Section 7 expenses can include the following:

- Post-secondary education

- Dental and medical insurance premiums

- Private school tuition or tutoring for primary and secondary school children

- Health expenses that annually amount to more than $100

- Childcare expenses that happen as a result of the primary parent’s illness, employment, education, employment training, or disability

These expenses will be divided between both parents based on the proportion of their income.

3. Courts Discretion to Deviate from Child Support Table Amount

As we mentioned before, if the income of the payer is more than $150,000, then the court has the option to deviate from the child support table amount.

However, there can also be some other cases where the court can exercise this discretion, which can include the following:

- The child is over the majority age

- The child is enrolled in post-secondary school and doesn’t live at home anymore

- The child support payer is not the biological parent but is acting in the place of the parent

- The parents have split the parenting time of the children equally

- When the child support table amount will cause undue financial hardship to the payer

Keep in mind this is not as simple as you might think. There are a lot of complexities that can come with these child support guidelines.

Let’s review each in detail to understand the child support laws better:

Child over the Age of Majority

Under Section 3 (2) of the child support guidelines, the court can order the table amount to be implemented or any amount it deems appropriate after assessing factors such as:

- The financial ability of each spouse

- Circumstances of the parents and child

- The needs of the child

What this means is that the court will consider each parent’s income and the ability of the child to support themselves.

Enrolment in Post-Secondary Education & Not Living at Home

If the child is enrolled in post-secondary education and doesn’t live at home, then the court might decide to award the child support table amount for the months the child spends at home.

However, they can deviate from the amount for the months that the child spends at school.

The court will decide the number of school months by looking at the costs of the overall maintenance of the child and the resources of the parents.

Then, it will divide the cost using Section 7, which means that the division will be proportionate to the income of both parents.

Not the Biological Parent

If the child is not the biological parent but is the step or adoptive parent or even a domestic partner, then the court has the discretion to deviate from the child support table amount.

The court will order the child support amount it deems appropriate, along with the legal duties of the parents with the child.

What this means is that if you are a step-parent, the court can adjust the support payments by taking into account the existing biological parent who is also paying for the child support.

Split Parenting Time of the Children

Parenting time will also determine the child support payments and their deviation. For example, if one or more children live with one parent 60% of the time and the remaining also live with the other parent at the same percentage, then the set-off amount will be applied.

Section 8 of the Child Support Guidelines governs this split. It states that the child support paid by the parent with the higher income to the one with the lower income will be the difference between the two table amounts.

In practical terms, this means that the court will look at the table amount for each parent. Then, it will subtract the lower amount from the higher one.

The difference will be paid to the spouse with the lower income, which is the set-off amount.

Child Support Payments Cause Undue Financial Hardship

Finally, under Section 10 of the Child Support Guidelines, if the table amount will cause undue financial hardship to the payer, then the court can deviate from this amount.

Please note that the Ontario Courts have emphasized that the undue hardship test is a challenging one to meet.

Firstly, if the payer thinks they will face undue hardship because of the payments, they will need to establish that their standard of living will be lower than the recipient parent.

Next, the payer will have to show that they meet the criteria specified in Section 10 (2) of the child support guidelines, which include the following:

- Other support duties

- Incurring high debts to earn a living or support the family before the separation

- Responsibilities for other children living in the house

- Significantly high expenses associated with parenting time

Only when you meet these criteria and establish a lower standard of living will the court deviate from the table amount to ensure you don’t face undue financial hardship.

What Factors Determine Child Support in Ontario?

View this post on Instagram

Here are some of the top factors that will determine the child support amount in Ontario:

1. Special Expenses

Special expenses can be any extraordinary or special expense. These can include health expenses, daycare costs, medical premiums, and much more.

Parents will share these expenses based on their income. Section 7 of the Child Support Guidelines governs special expenses.

2. Parenting Arrangements

The parenting arrangement will also determine how much the child support amount will be. The courts will decide the amount based on whether you have split or shared custody.

3. Retroactive Support

The court can order retroactive support when the parent has the legal obligation to pay but hasn’t made the payments or paid a lesser amount than designated.

As the recipient, you can claim up to three years in the past for retroactive support.

We recommend you have proof that you requested child support and an explanation as to why you didn’t seek the said support in court at an earlier date.

4. Financial Difficulties at the Payers End

Finally, if the payer is going through financial difficulties, then this will also affect the child support amount you may receive. However, proving this in Ontario is difficult, and there has to be evidence that proves undue financial hardship.

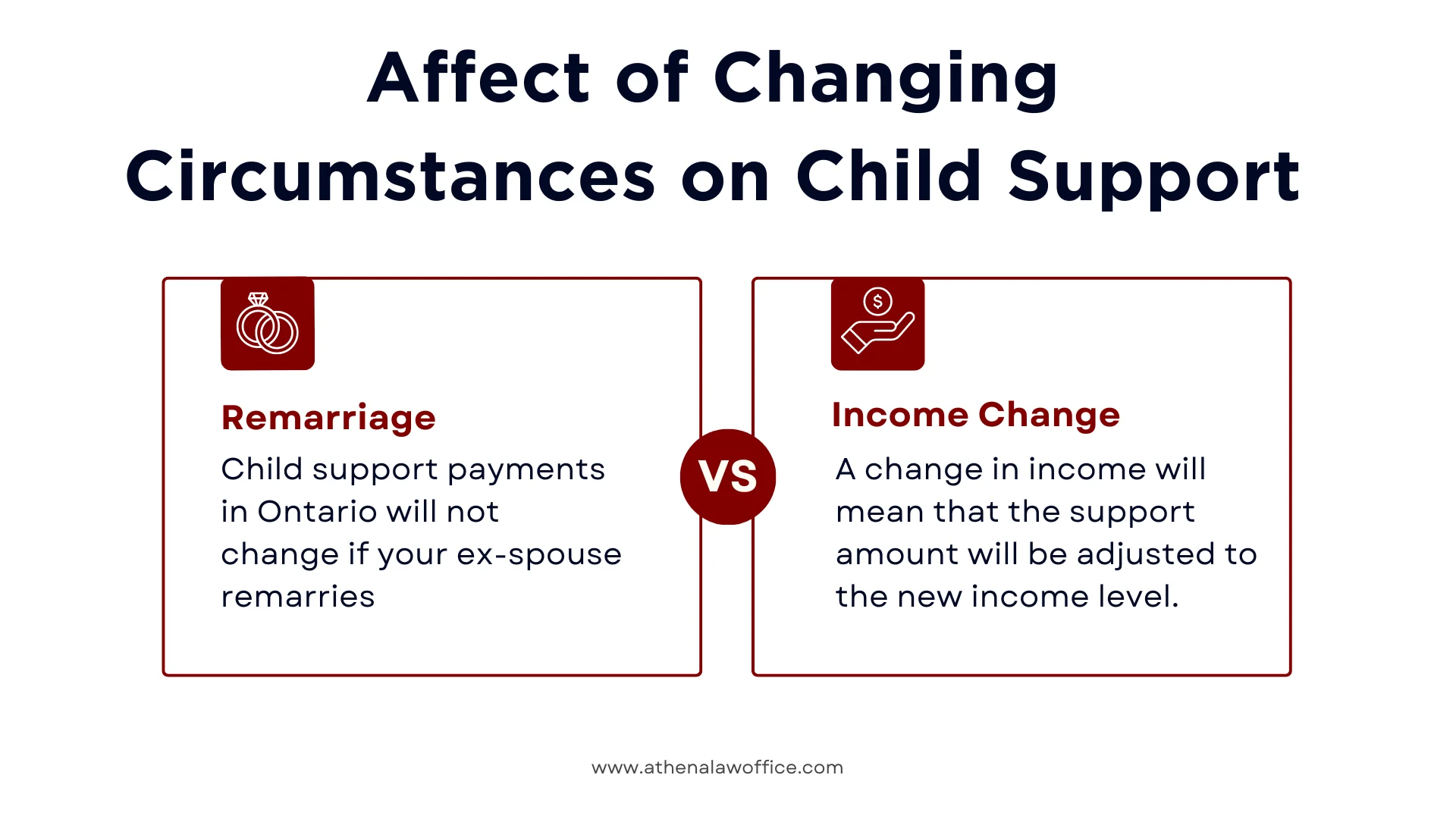

How Changing Circumstances Change Child Support Payments in Ontario

Things never remain the same. Incomes change, spouses change, jobs change, and that is the nature of life.

Because of this, it is important to understand whether child support payments will change based on your circumstances or not.

We have reviewed some possible circumstance changes in detail and let you know what will happen to the child support payments:

Does Child Support Amount Change if Spouse Remarries?

No, child support payments in Ontario will not change if your ex-spouse remarries. The child support table amount will still remain the same because the obligation of the support is to the child directly.

All children have the right to benefit from the financial means of their parents. Regardless of the circumstance of the parent, the child’s rights will not be affected.

How Change in Income Affects Ontario Child Support

In certain cases, a change in the income of the spouse will affect Ontario child support. For example, if the income of the recipient increases, then this will affect how the Section 7 expenses are divided between the spouses.

The reason for this is that these expenses are divided between both spouses based on the proportion of each spouse’s income.

On the other hand, a change in income will also mean that the support amount will be adjusted based on the table amount applicable to the new income level.

So, as the income changes, the child support payments will change, too.

How to Begin a Child Support Application in Ontario?

Following the right legal process is important when adhering to the child support guidelines. Let’s review the steps you can follow to begin the child support application in Ontario without any difficulty:

1. Fill Out the Court Forms

The first thing you need to do is complete the forms that will help you file the correct child support applications. Form 8 is the first one you should fill out, and it is a general application of your details.

Then, you must fill out Form 13, which is the financial statement (support claims). This form is applicable if you are seeking support for special expenses.

During the application process, you have to show that you are a parent and that the children also live with you most of the time.

If you are worried about how to fill these forms and want to reduce chances of errors, you can get in touch with our family lawyer in Ontario. We will help you throughout this process at every step of the way.

2. Take the Documents and Copies to Court

Once you have the documents and application, it is time to take them to the court clerk. We recommend taking at least three copies to ensure that your documents are not lost.

If you go to the Ontario Court of Justice, you must go toward their family counter. On the other hand, if you go to the Superior Court of Justice, then you have to get a number and wait for your turn.

They will provide you with your file number and a notice to attend a program session that is mandatory for both parties and will offer you relevant information.

The purpose of this session is to ensure that you are familiar with the family court and law. Please remember that you and the other party will not be scheduled for the same day.

3. Serve the Application

Now, it is time to serve the application. Get someone else to give a copy of the documents filed with the court and the mandatory program notice and serve them to the other party.

Please note that you are not allowed to serve the documents yourself. Instead, you will have to find someone 18 or above to hand deliver a copy of these documents to your ex-spouse or partner.

Another thing you must do is file proof that the documents were given to the other party. You must create an affidavit for this, and the person serving the documents will have to sign it to ensure proof.

4. Complete Affidavit of Service

Once you have the affidavit of service, which is the document showing you have served the application to the other party, it is time to complete the process.

The affidavit has the date and time you have served the application to the other party, along with who served them and how they served.

This is one of the most important documents you can have in the child support process in Ontario. If the other party claims that they were not notified, then this document will serve as proof.

For this, you must complete Form 6B, which is the affidavit of service sworn and affirmed. We also recommend you include any other documents that will support the serving.

For example, if you use registered mail for this purpose, then print the delivery confirmation and include the signature that verifies the invoice on the Canada Post website.

5. File the Documents

By now, you have done almost everything to follow the child support guidelines for filing successfully. Now, you must take all the documents to the family court clerk and keep them in a continuing record.

This is the record at the court of all the documents you have filed till now. Please note that before you do this, make sure to update the table of contents.

This list of all documents and forms you have added to your court file needs to be updated every time you add new documents. If you are confused about this, you can always ask the family court clerk to help you out.

The Enforcement of Child Support Through the FRO

The FRO (Family Responsibility Office) is responsible for enforcing child support payments and agreements that you file with them. They are a branch of the Ontario government, which is why they are important when enforcing child support payments:

You can register a support obligation with the FRO, and they will forward the payments to the recipients. If your spouse fails to make payments, then the FRO can enforce the obligation using these methods:

- Suspending the driver’s license of the paying parent

- Withholding the wages of the payer or any money received from the government. This can include worker’s compensation, Canada Pension Plan benefits, old age security benefits, and more

- Withholding the income of the paying parent or directing the employer to deduct child support payments from the income and remit the funds to the recipient

- Suspending the passport of the paying parent

- Reporting the paying parent to the credit bureau so they can’t get a loan in the future

- Reporting the paying parent to the professional or occupational organization they might belong to

- Suspending any federal licenses

- Create an order against anyone helping the paying parent hide their income

- And more

In the event that none of these methods work, the FRO can bring the paying parent to court for being in contempt of the child support order. At the discretion of the court, they can be fined or imprisoned.

FAQs

How much child support does a father have to pay in Ontario?

The father will have to refer to the child support table in Ontario to determine the payment based on gross annual income and the number of children. The table amount will be the amount that they owe.

What are the laws on child support in Ontario?

Child support payments need to take place if the child is under 18. In some circumstances, the court can decide to extend this timeframe. For more information, you can refer to the federal child support guidelines.

What is the cut-off for child support in Ontario?

The age of majority is the cut-off for child support payments. When the child turns 18 years old, they are not eligible to receive child support. However, if they are still dependent, then the child support can continue.

Contact a Child Custody Lawyer in Ontario for more Assistance

That was everything you needed to know about the child support guidelines in Ontario. The law may seem straightforward at first, but its legal implications will depend on your specific case.

Because of this, it is important to hire a child custody lawyer in Ontario to assist you during this process. Athena Narsingh is one of the top family lawyers in Scarborough who will compassionately help you during this emotionally complex process.

For more information, you can get in touch with our law office.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario? legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario?

legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario? Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025?

Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025? Family LawOctober 22, 2025Divorce Rate In Canada 2025: Top Divorce Statistics To Know

Family LawOctober 22, 2025Divorce Rate In Canada 2025: Top Divorce Statistics To Know