Divorce means dividing properties, finances, and everything else you and your spouse once shared together. However, you might wonder, “Can my ex-wife claim my pension years after divorce in Canada?”

The answer is yes, she can. But there is a lot more to it than just this simple answer.

Keep reading our guide to understand more about CPP credit splitting and how spouses can claim this amount under the Canada Pension Plan.

What is CPP Credit Splitting?

CPP credit splitting is when the contributions you and your ex-spouse or common-law partner made during the time you lived together need to be divided after you have decided to separate or divorce.

You can divide these credits even if one of the spouses did not make contributions to the CPP. Please note that when you decide to divide these credits, they will be permanent.

Eligibility Criteria for CPP Credit Splitting

It is important to understand whether you are eligible for CPP credit splitting. The splitting will vary depending on whether you are separated or divorced or whether you were in a common-law relationship or marriage.

You will not be eligible for CPP credit splitting when:

- The total pensionable earnings of the former common-law partner or spouse or spouse did not exceed more than twice the Basic Exemption of the Year

- The period of time is before one spouse, ex-spouse, or ex-common-law partner reaches the age of eighteen

- The period of time is after the spouse, ex-spouse, or ex-common-law partner reaches the age of 70

- The period of time that one of the spouses, ex-spouses, or ex-common-law-partner was disabled for the CPP disability benefit

- The period of time that one of the spouses, ex-spouses, or ex-common-law-partners was a beneficiary of a retirement pension under the CPP

On the other hand, here is the eligibility criteria for CPP credit splitting based on different factors:

Couples That Have Gotten Annulment or Divorce

If your marriage has ended in an annulment or divorce on or after January 1987, then you will be eligible for CPP credit splitting if you meet the following criteria:

- You lived with your ex-spouse for twelve consecutive months

- You or your ex-spouse has notified Service Canada and has provided the relevant information for this purpose

Please note that having a spousal agreement will not prevent a credit split. However, spousal agreements entered into before June 4, 1986, will prevent credit splitting, and spousal agreements in BC, Quebec, Saskatchewan, and Alberta have a provincial law allowing couples to agree not to split CPP credits.

On the other hand, if your marriage ended in an annulment or divorce between January 1, 1978 and December 31, 1986, then you will qualify for CPP credit splitting after you have met this criteria:

- You and your ex-spouse lived together for 36 consecutive months on a stretch

- Your annulment or divorce was recognized by the country’s law

- You and your ex-spouse applied for CPP credit splitting in writing and sent the government the necessary documents thirty-six months after the marriage had terminated

Finally, if your marriage ended in annulment or divorce before January 1, 1978, then you will not be eligible for a CPP credit split. This is because CPP credit splitting did not exist before January 1978.

Separated Couples

Suppose you are still married to your spouse, and your separation took place on or after January 1987. In that case, you will be eligible for credit splitting after meeting the following eligibility conditions:

- You have lived with your spouse for twelve consecutive months

- You have not been living with your spouse for twelve consecutive months

- You or your spouse have applied for the splitting in writing and have sent the required documents to the Canada Pension Plan

Please note that there is no time limit for applying for this. However, if your spouse has passed away, then you must apply within 36 months of their date of passing.

Ending of Common Law Unions

Even people who have terminated their common-law union in Canada are eligible for CPP credit splitting. If you terminated your common-law union on or after January 1987, then you will have to fulfill the following eligibility criteria:

- You and your common-law partner lived together for twelve consecutive months

- You have not been living with your common-law partner for twelve consecutive months

- You and your ex-common-law partner apply in writing and send the CPP the required documents within forty-eight months of the date when you began living separately

How Much Can You Expect to Receive from CPP Credit Splitting?

You might also want to know the exact amount you can expect to receive from the credit splitting. However, this can vary, depending on your situation.

For example, in certain situations, credit splitting can have a significant impact on your future CPP benefit amounts. Moreover, in other situations, the splitting may not be that significant.

The child-rearing and dropout provisions can impact your credit split very little. You can connect with a family lawyer, as they will answer this better, depending on your circumstances and let you know how much you can expect to receive from the CPP credit splitting.

When to Apply for CPP Credit Splitting

Now, you might wonder when it is appropriate for you to apply for CPP credit splitting. The only time you can apply for this is after your divorce, annulment, or separation from marriage or common-law partnership.

As soon as these events take place, we recommend you apply for credit splitting and submit the necessary documentation.

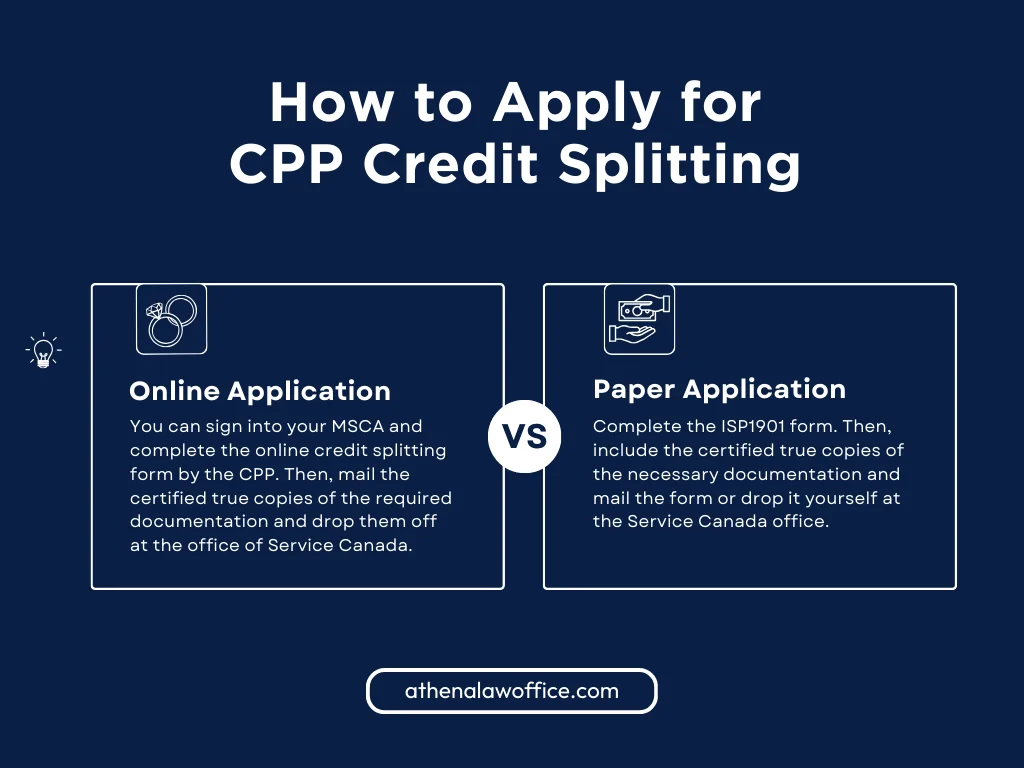

How to Apply for CPP Credit Splitting

If you want to begin the CPP credit splitting process, you must fill out your application. Here are two ways you can follow:

- Online Application: You can sign into your MSCA and complete the online credit splitting form by the CPP. Then, mail the certified true copies of the required documentation and drop them off at the office of Service Canada.

- Paper Application: Complete the ISP1901 form. Then, include the certified true copies of the necessary documentation and mail the form or drop it yourself at the Service Canada office.

Can Ex-Wife Claim My Pension Years After Divorce in Canada?

Yes, your ex-wife can claim your pension even after years of divorce in Canada. There is no time limit to this unless you pass away.

If that is the case, then your ex-wife will have 36 months from the date of the death to apply for the CPP credit splitting. Until then, she can claim the pension even after years of divorce in Canada.

Is CPP Splitting Worth it?

A CPP credit splitting can be worth it if one of the spouses has a lower income. It can help ease the lower earners’ financial burdens after the termination of a marriage.

On the other hand, it can provide potential income tax savings for both partners in the marriage.

FAQs

Can I collect my ex-husband’s CPP?

Under the CPP, you are allowed an equal division of CPP credits that you and your spouse, ex-spouse, or ex-common-law partner gathered during the time you were living together.

Can I still get my ex-husband’s pension?

Yes, you can claim your husband’s pension even after a divorce. To receive the pension, you must fulfill the eligibility criteria and send the required documents.

How is pension value calculated for divorce in Canada?

The value will be based on the pension earned during the time you and your spouse were living together. You can get in touch with a family lawyer to understand this better and get legal advice on credit splitting.

Do I lose my husband’s pension if I remarry?

No. The survivor benefit is to be paid for life and will not be affected by remarrying. So, the pension will continue even if you remarry.

Contact a Trusted Family Lawyer in Scarborough for Legal Advice

CPP credit splitting can be useful for spouse earning a lower income to help ease their financial burdens. An ex-wife can claim pension years after divorce, but if the husband passes, then there is a 36-month time limit from the date of passing.

If you need legal advice on family matters or divorce, contact our trusted family lawyer in Scarborough. We aim to help everyone struggling with complex family law matters.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

legal guidanceFebruary 18, 2026NRST Rebate: Definition, Types, And Application Method

legal guidanceFebruary 18, 2026NRST Rebate: Definition, Types, And Application Method legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario?

legal guidanceFebruary 6, 2026How To Avoid Foreign Buyer Tax Ontario? Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?