Understanding Canadian real estate taxes can be overwhelming, especially if you’re a non-resident. The housing market is governed by various regulations that apply different taxes, such as the land transfer tax (LTT) and non-resident speculation tax (NRST), during the house closing process.

If you’re buying a home in Canada for the first time as a non-resident, familiarizing yourself with the NRST will help you understand your total house closing costs. Dive into our guide below to learn more about this tax.

What Is Non Resident Speculation Tax?

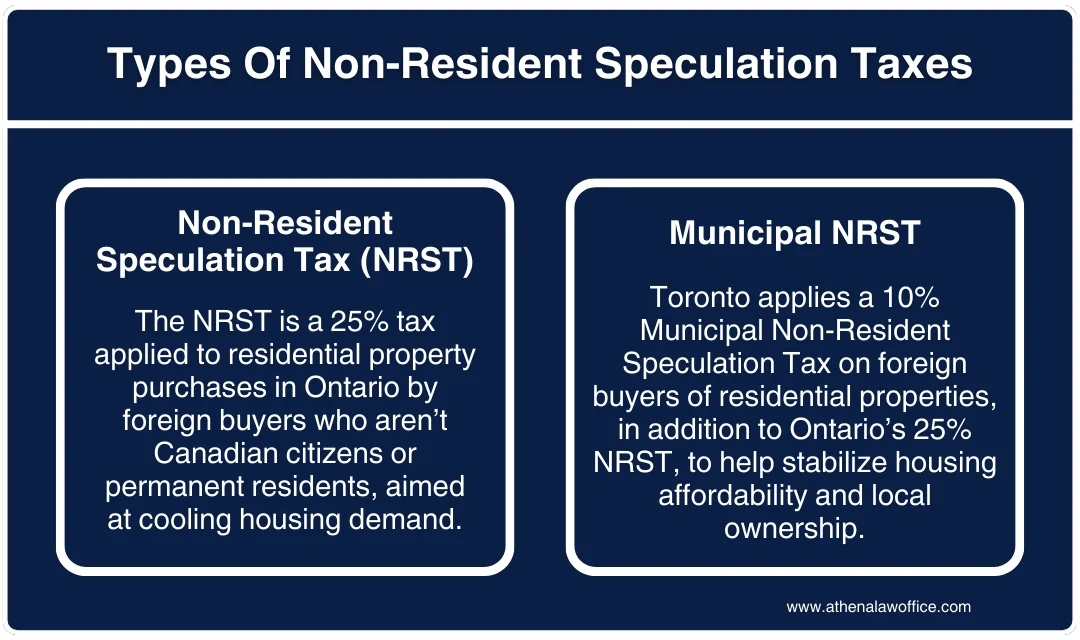

The NRST, aka the foreign buyer’s tax, is a charge that was introduced in April 2017 in Canada. This tax applies when non-residents purchase a residential property or acquire an interest in a property anywhere in Ontario. The standard rate of non-resident speculation tax in 2025 is 25%.

Non-citizens and non-residents are required to pay the NRST during house closing. When registering a land electronically, you can pay the non-resident speculation tax online immediately. If you’re registering the property in person, you must pay the NRST before submitting the paperwork for registration to the Ministry of Affairs.

What Is Municipal Non Resident Speculation Tax?

The Municipal Non-Resident Speculation Tax (MNRST) was introduced in 2024 and took effect from 1st January 2025. It is an additional tax that applies to non-residents buying a residential property in Toronto.

This tax is not applied on top of the NRST, but is a separate charge. Imagine you’re a non-resident buying a home in Toronto. You will be expected to pay the standard rate of NRST because the city is in Ontario.

Since the property is in Toronto, you must also pay the MNRST because it is not covered under the provincial non-resident speculation tax. The standard rate of this municipal charge is 10% of the purchased property’s total value.

Who Needs To Pay Non Resident Speculation Tax?

As the name suggests, NRST is for non-residents in Canada, but you may wonder what exactly that means. Let’s break it down:

-

Foreign Entity

A foreign entity is a foreign national defined under the Immigration and Refugee Protection Act. The regulation states that such an individual is:

- Someone who is not a Canadian citizen

- Someone who is not a permanent resident of Canada

If you meet both criteria, you will be considered a foreign entity and be subject to the non-resident speculation tax.

-

Taxable Trustees

Under the foreign buyer’s tax, a taxable trustee is also a liable party to pay this charge. This refers to either:

- A trustee of a trust with at least one foreign entity

- A trustee of a trust where none of the trustees are foreign entities, but at least one beneficiary is a foreign entity

If one of the criteria is fulfilled, you must pay the foreign buyer’s tax in Ontario. However, some trusts are excluded from the earlier definition. These include mutual fund trusts, real estate investment trusts, and specified investment flow-through trusts (SIFTs).

-

Foreign Corporation

Foreign corporations are also subject to NRST under Ontario real estate laws. They may include:

- A corporation that is not incorporated in Canada (no physical presence in the country)

- A corporation that is incorporated in the country but whose shares are not listed on a stock exchange in Canada

- A corporation that is controlled by one or more foreign entities

If a corporation’s documents are set in a way that a foreign entity can elect a board of directors, it will also be considered a foreign corporation. This is regardless of the share ownership.

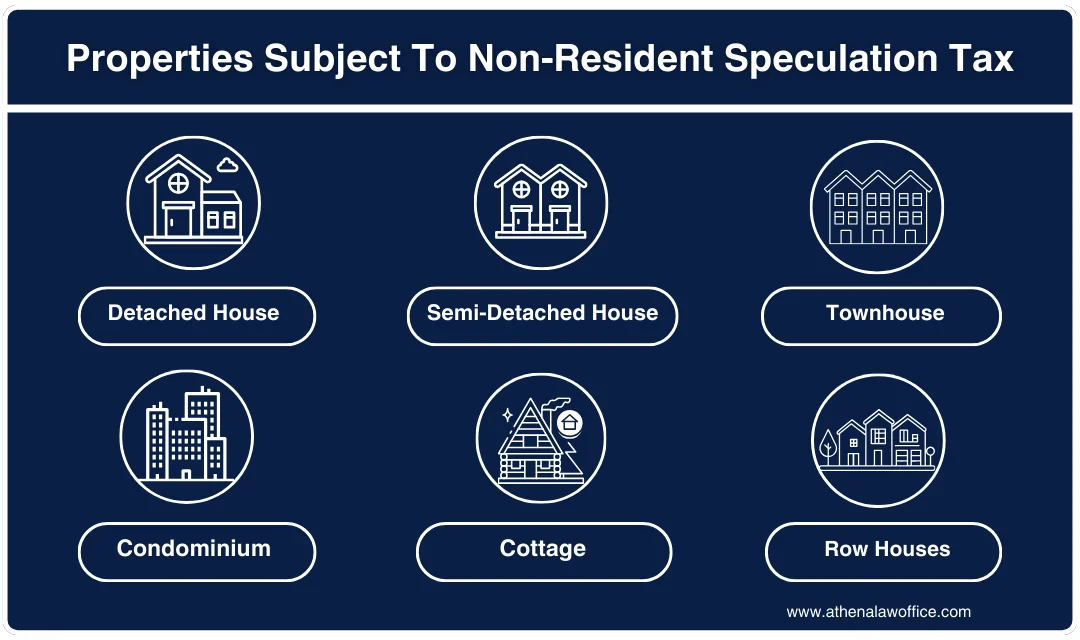

What Properties Are Not Subject To Non Resident Speculation Tax Ontario?

The non-resident speculation tax mainly applies to residential properties in Canada. It doesn’t include commercial spaces such as an office building. Industrial lands, agricultural properties, and lands holding more than six-family residences are also not subject to NRST.

If a property is partially used as a residential space by a foreign entity, corporation, or taxable trustee, NRST will only apply to the residential value of consideration.

Let’s imagine you purchased a property that contains a residence with a consideration value of $1,500,000 and commercial space with a value of $1,000,000. The foreign buyer’s tax is for residential spaces, so it will only apply to $1,500,000. No tax will be imposed on the commercial land space.

How Much Is The Non Resident Speculation Tax In Ontario?

The rate of non-resident speculation tax in Ontario is 25% as of 2025. All online NRST calculators use this rate to help you calculate your payable tax. You can also calculate the tax yourself by using the following formula: Property purchase price x 25% = Payable NRST.

For example, if you purchase a residential home for $2,000,000 in Ontario, the NRST will be calculated as follows:

- Property purchase price x 25% = Payable NRST

- $2,000,000 x 25% = $500,000

- Payable NRST = $500,000

During property registration, you must pay $500,000 as the non-resident speculation tax. Apart from this tax, other charges may also affect your house closing costs such as the MNRST and land transfer tax.

Does Non Resident Speculation Tax Apply To The Land Transfer Tax?

Many Canadians and non-residents believe the LTT and NRST to be the same. They are two different taxes that apply during the same time, i.e. at house closing. The Ontario land transfer tax is a charge that all homebuyers must pay, including Canadian citizens, permanent residents, and non-residents.

NRST is a foreign buyer’s tax that only applies to non-residents. Even if you’re purchasing a joint property with a Canadian citizen, you will not be exempt from paying the tax.

FAQs

Are Non Resident Speculation Tax And Foreign Buyer Tax The Same?

Yes, non-resident speculation tax and foreign buyer tax refer to the same additional charge that is imposed on foreign entities, corporations, and taxable trustees during residential house closings in Ontario.

What Is The Non Resident Tax Rate In Ontario?

As of 2025, the non-resident tax rate is 25%. From April 2017 to March 2023, the tax rate was 15% but was increased to 20%. After October 2022, the figure was increased to 25% and has remained the same since then. Knowing these transitions in the NRST rate is important because a different rate may apply to your case, depending on your house closing date.

Can Canadian Citizens Be Subject To The NRST?

Yes, Canadian citizens may be subject to the NRST if they own a property share with a foreign entity or a taxable trustee. If the non-residents don’t pay the NRST, other transferees in the property transaction will be liable to pay the tax. This rule applies even if the transferees are permanent residents or Canadian citizens.

How To Avoid Foreign Buyer Tax In Ontario?

If the transferee (person to whom the new property is being transferred) is a nominee, such as a spouse of a Canadian citizen, they may be exempt from paying the foreign buyer tax. All Ontario land transfer tax exemptions under the real estate laws also apply to the NRST.

Who Can Help You Pay Non Resident Speculation Tax?

A skilled real estate lawyer can help you pay your non-resident speculation tax online or in person before the house closing. The professional can let you know the payable amount by using the non-resident speculation tax calculator. They will also develop documents that will be required when paying the residential tax.

Avoid Missing Non Resident Speculation Tax Deadline With Barnett Law

Navigating the non-resident speculation tax in Ontario can be tricky if you’re new to the housing market. Barnett Law can assist you by explaining you provincial and municipal laws surrounding the foreign buyer’s tax.

Our skilled team can help you understand whether or not you’re exempt from paying the tax, calculate the payable amount, and file the charge legally. Contact us today to speak to one of our real estate lawyers about Ontario’s non-residential speculation tax.

Author Profile

- Barnett Law is a trusted and knowledgeable lawyer in Scarborough. Her expertise spans real estate law, family law, adoptions and fertility law. A lawyer by profession and a humanitarian by heart, Athena Narsingh Barnett wants to help people become more familiar with the legal system and be well-informed to make important legal decisions.

Latest entries

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners

Real Estate LawJanuary 30, 2026Non Resident Speculation Tax Explained For Beginners legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario?

legal guidanceNovember 12, 2025How To Avoid Land Transfer Tax Ontario? legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario?

legal guidanceOctober 31, 2025How Much Is Land Transfer Tax In Ontario? Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025?

Family LawOctober 27, 2025How Much Does A Divorce Cost In Ontario In 2025?